Track stocks on the Singapore Exchange with Sharesight

Sharesight’s portfolio tracker allows investors to track stocks and ETFs on the Singapore Exchange (SGX), with automatic dividend tracking and daily price and performance updates. This is in addition to our existing support for other key markets such as the Shanghai Stock Exchange (SSE), New York Stock Exchange (NYSE), Nasdaq and over 40 other leading global markets. Our extensive market and broker support also allows investors to effortlessly track all their investments in one place, while taking advantage of Sharesight’s powerful performance reports, dividend tracking and tax reporting features.

What is the Singapore Exchange?

Founded in 1999, the Singapore Exchange (SGX) is Singapore’s primary stock exchange. The exchange allows investors to trade and invest in stocks, bonds and options, along with forex and commodities following its acquisition of the Singapore Commodity Exchange in 2008.

Why investors should track their SGX investments with Sharesight

With Sharesight, investors can easily track the price and performance of stocks listed on the Singapore Exchange, alongside investments across multiple global markets, asset classes and brokers. By consolidating all of their investments in Sharesight, investors gain a portfolio-wide view of their performance, benefitting from daily price updates for the SGX, plus advanced reporting designed for the needs of self-directed investors. In addition, Sharesight’s annualised performance calculation methodology gives investors the complete picture of their portfolio returns by calculating the impact of capital gains, brokerage fees, dividends and foreign exchange rates on performance.

Track dividend income from SGX stocks

Unlike other portfolio trackers, Sharesight automatically tracks dividend and distribution income and includes this information when calculating your investment return. In the screenshot below for example, dividends make an important contribution to this stock’s returns, highlighting the value of a portfolio tracking solution that includes more than just capital gains in its performance calculations.

An example of an SGX stock in an investor’s portfolio, with dividends contributing 4.63% to the total return, along with 18.42% in capital gains and -0.20% in currency gains.

Run powerful performance reports built for investors

For investors who want a more detailed breakdown of their portfolio’s performance, Sharesight offers a range of powerful reports including:

-

Performance: Calculate your total portfolio returns over any selected period.

-

Diversity: Discover how the assets in your portfolio are diversified across different investment sectors, investment types, countries and markets.

-

Contribution analysis: Measure the impact of your holdings and asset allocations on your overall portfolio performance.

-

Future income: View announced dividends and interest payments expected for investments in your portfolio.

-

Multi-currency valuation: See the value of your holdings denominated in the currency of your choice.

-

Multi-period: Compare your portfolio returns over different time frames to see the impact of time on your performance.

Calculate the impact of SGX investments on your portfolio’s returns

In the screenshot below, you can see the contribution analysis report (sorted by market) being used to assess the ‘weight’ of various markets in a US investor’s global portfolio. This would be particularly useful for an investor looking to compare the relative contribution of their SGX investments to the total return on their portfolio, for example.

In this example, the Tokyo Stock Exchange (TYO) is the most significant contributor to the portfolio’s returns, accounting for 10.02% and $13,531.14; while the Nasdaq is the biggest detractor from the portfolio’s returns, accounting for -71% and -$95,883. The SGX lies somewhere in the middle, accounting for 4.32% and $5,837.34. The report also includes a detailed breakdown of each individual holding’s returns.

The contribution analysis report being used for a US investor’s global portfolio, including stocks and ETFs on the ASE, NASDAQ, NYSE, SGX and TYO, as well as US funds and foreign exchange.

How to track stocks on the Singapore Exchange with Sharesight

-

If you’re not using Sharesight yet, sign up for a FREE account to get started.

-

Add your holdings to your portfolio by searching for the relevant stock code under the market code SGX. Alternatively, you can add holdings through Sharesight’s File Importer feature.

-

Sharesight will automatically fill in the price history and performance valuation for your holdings by end-of-day on a daily basis. It will also backfill past dividends (and continue to add new ones as they are announced) – plus factor in the impact of any currency fluctuations on your performance.

Track all your investments in one place with Sharesight

Investing in assets on the Singapore Exchange and other global markets? Sign up for Sharesight so you can:

-

Track all your investments in one place, including stocks in over 40 major global markets, mutual/managed funds, property, and even cryptocurrency

-

Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

-

Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, multi-period, multi-currency valuation and future income (upcoming dividends)

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends and capital gains with Sharesight’s annualised performance calculation methodology

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

FURTHER READING

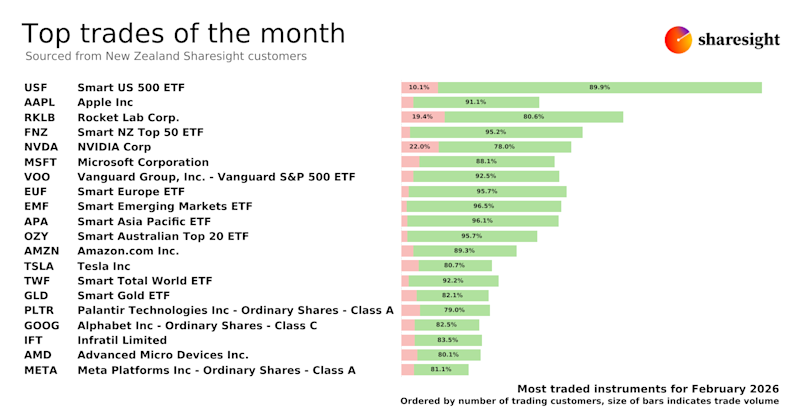

Top trades by New Zealand Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

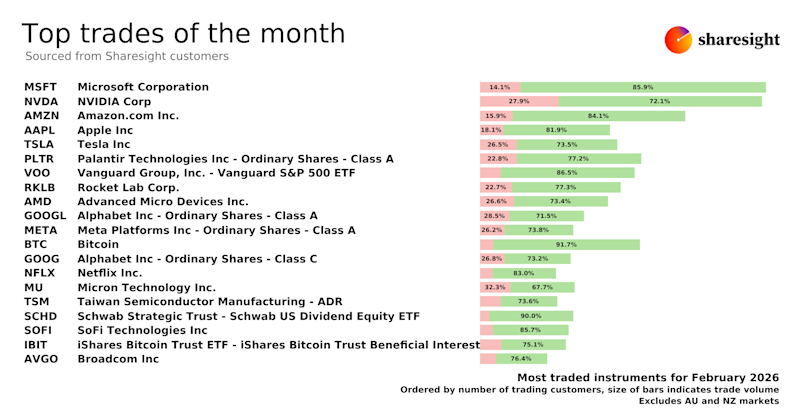

Top trades by global Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.

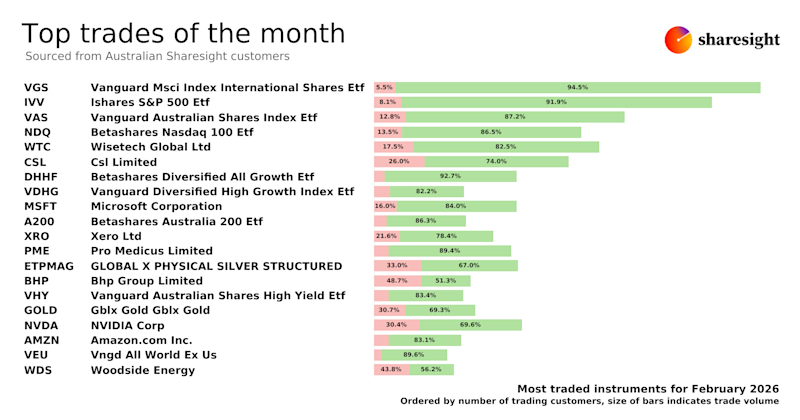

Top trades by Australian Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Australian Sharesight users.