Track fractional shares on any stock exchange

Sharesight has expanded our support for tracking fractional share trades on markets that support it to also include support for fractional shares on exchanges that may only permit trading in whole share units.

Track fractional shares on any exchange? Why?

While you may not be able to purchase fractional shares on all exchanges (for instance, the NZX or ASX), there are some instances where investors could need to track fractional quantities. Most commonly this will arise when investing through a robo-advisor or micro savings/investment apps like Raiz (formerly Acorns Australia), Sharesies in New Zealand, or Wealthsimple that allocate fractions of ETFs to investors to invest the full amount "saved".

Tracking fractional shares with Sharesight

Supported exchanges that allow fractional shares:

In addition to allowing fractional quantities for interest rate instruments and managed funds, Sharesight now supports fractional quantities on the following markets (new exchanges in italics):

-

AMEX (NYSE American)

-

ASX (Australian Stock Exchange)

-

BIT (Borsa Italiana)

-

BME (Bolsa de Madrid)

-

BSE (Bombay Stock Exchange)

-

CNSX (Canadian Securities Exchange)

-

CVE (Toronto TSX Ventures Exchange)

-

EURONEXT

-

FRA (Frankfurt Stock Exchange)

-

HKG (Hong Kong Stock Exchange)

-

JSE (Johannesburg Stock Exchange)

-

LSE (London Stock Exchange)

-

NASDAQ

-

NSE (National Stock Exchange)

-

NYSE (New York Stock Exchange)

-

NZX (New Zealand Stock Exchange)

-

SGX (Singapore Stock Exchange)

-

SWX (Swiss Exchange)

-

OTC (Over the Counter)

-

OTCBB (Over the Counter Bulletin Board)

-

TSE (Toronto Stock Exchange)

-

TYO (Tokyo Stock Exchange)

Why buy fractional shares?

Aside from the circumstances above that may result in being allocated fractional quantities of shares, fractional shares offer investors the following benefits/caveats:

Benefits of fractional shares

-

Lets you put your cash to work immediately (rather than waiting to buy a whole share)

-

Helps you best balance your portfolio allocation (single units of a highly-priced share can distort small portfolios)

-

Allows you to make the most of dollar cost averaging

Caveats of fractional shares

-

If you own less than 1 share, you typically can’t vote in company elections

-

Rounding may impact your ability to receive dividends - if you own 10% of a share, and that share pays a 1 cent dividend, you may not receive a dividend payment at all

-

Brokers that offer fractional share quantities may charge additional fees for the service

Track fractional shares with Sharesight

Track fractional investments with Sharesight, the award winning portfolio tracker built for investors like you:

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

-

Sharesight automatically tracks your daily price & currency fluctuations, as well as handles corporate actions such as dividends and share splits

-

Run powerful tax reports built for investors, including, Capital Gains Tax (Australia and Canada) Traders Tax (NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

FURTHER READING

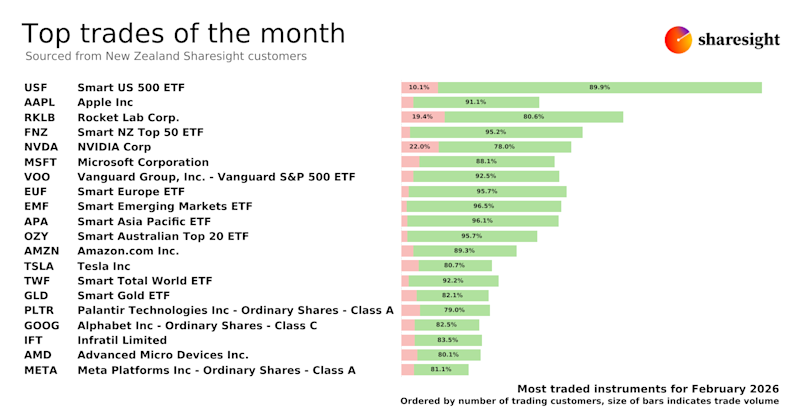

Top trades by New Zealand Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

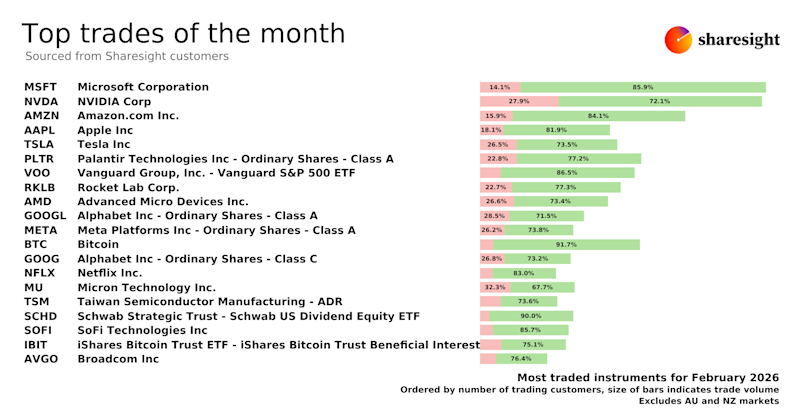

Top trades by global Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.

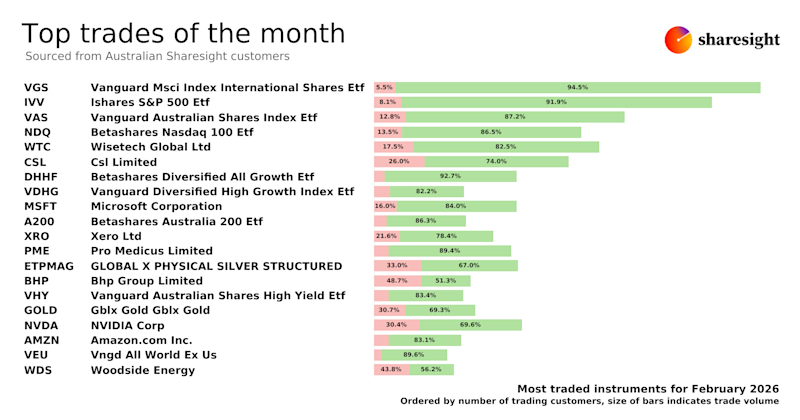

Top trades by Australian Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Australian Sharesight users.