Tip #17 - Don’t fall prey to “shoebox syndrome”

Every week we post a tip that we hope will help you become a successful share market investor.

Tip#17 — Don’t fall prey to “shoebox syndrome”

As all share market investors know, the benefits of being in the market come with responsibilities to the tax office, not to mention the need to provide information to your accountant and frequently other interested parties as well. If you’re not prepared to keep your paperwork in good order throughout the year, or use an online share portfolio management service to do it for you, you most likely will end up in a last-minute scramble to get your affairs in order.

Paperwork haters like me know the shoebox drill – hunting around at the 11th hour (13th hour?) for trade confirmations / contract notes and dividend statements, scouring through bank statements and desperately trying to remember details of share splits, bonus issues and everything else that happened in your portfolio over the last year.

This information is not a recommendation nor a statement of opinion. You should consult an independent financial adviser before making any decisions with respect to your shares in relation to the information that is presented in this article.

FURTHER READING

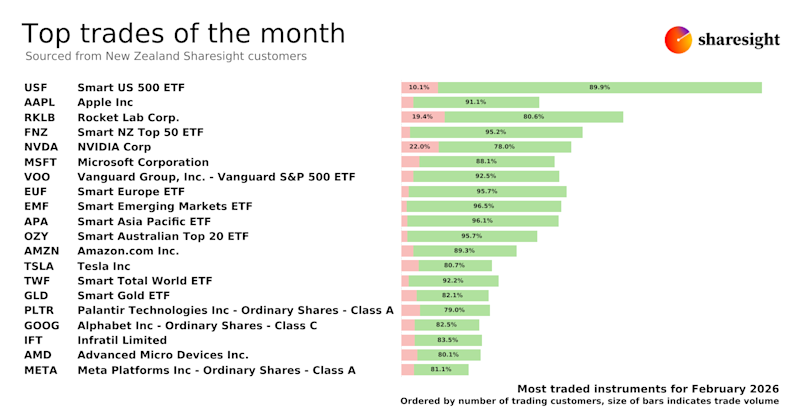

Top trades by New Zealand Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

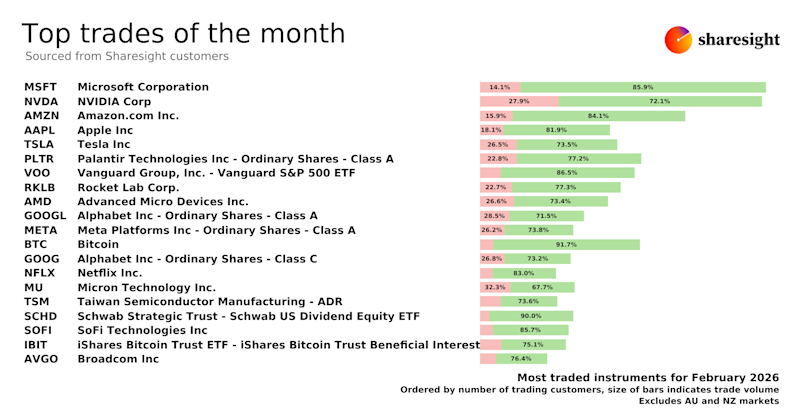

Top trades by global Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.

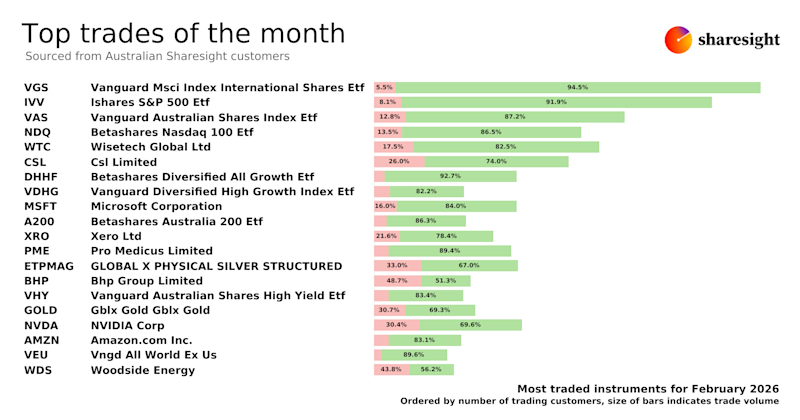

Top trades by Australian Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Australian Sharesight users.