Record-keeping requirements for DIY share market investors

Every week we post a tip that we hope will help you become a successful share market investor.

Tip#15 — Record-keeping requirements for DIY share market investors

Many DIY investors become distracted by the administrative tasks associated with managing their portfolio. Essential tasks include:

-

Recording dividends declared and paid to ensure you have dividends statements. Be sure to record franking and other elements such as foreign tax credits.

-

Reconciling dividends against bank statements to ensure you haven’t missed out on any payments due. And make sure there are no anomalies that could cause you issues come tax time.

-

Reviewing your cost bases so that you know both your unrealised and realised capital gains tax position.

If you hate paperwork look for an online system that can automate the recording of transactions and other relevant share investment activity and produce all the information required to complete your tax return in a few clicks.

This information is not a recommendation nor a statement of opinion. You should consult an independent financial adviser before making any decisions with respect to your shares in relation to the information that is presented in this article.

FURTHER READING

Sharesight users' top trades – December 2025

Welcome to the December 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users over the month.

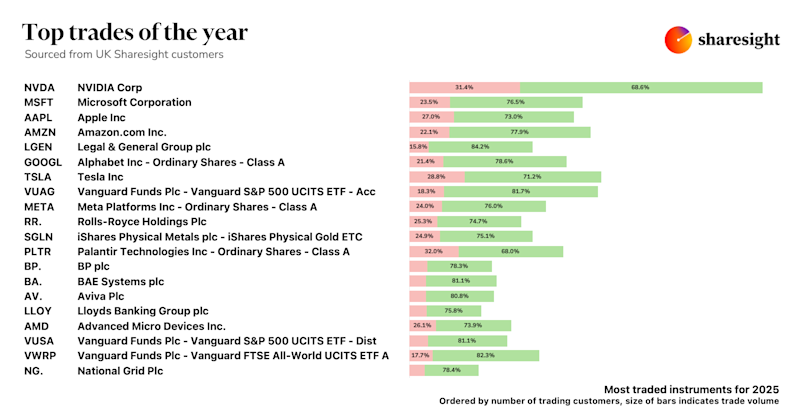

Top trades by UK Sharesight users in 2025

Welcome to the 2025 edition of our UK trading snapshot, where dive into this year’s top trades by the Sharesight userbase.

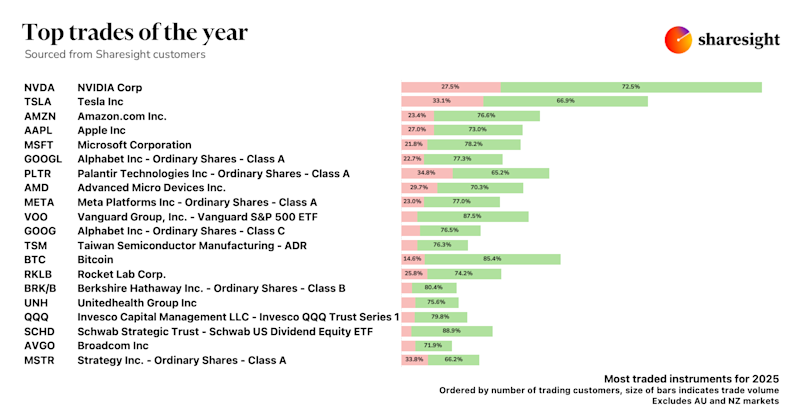

Top trades by global Sharesight users in 2025

Welcome to the 2025 edition of our global trading snapshot, where we dive into this year’s top trades by Sharesight users around the world.