The Sharesight Story

Embedded content: https://www.youtube.com/embed/QZl0rfarp6Q?rel=0&showinfo=0

Seven years ago my son Scott and I developed Sharesight. We began by asking ourselves a few basic questions, which turned out to be awfully relevant for investors of all stripes.

When you have finally paid off your mortgage and you ready to do some serious saving, where is the best place to put your hard earned cash?

In the bank? Debentures? Bonds? Buy a rental property? Or maybe you could stick it in the share market? Surely not the share market. Everyone has heard of the Wall Street crash and the periodic crashes that have followed.

When I eventually became mortgage free I did some research to answer the big “where to invest” question. To my surprise I discovered that over the long term the share market was hard to beat despite the well-publicised crashes.

Next question: Who should I use to manage my share investments? More research and another surprise. Most investment advisors struggle to outperform market averages. Worse still they charge like wounded bulls but provide you with a very basic record of your investments to say the least and no meaningful performance information at all.

The solution was obvious. I’d do everything myself. Problems solved. Well... not quite. Two things drove me nuts.

-

Record keeping for tax and accounting purposes was a time-consuming pain in the neck.

-

How could I be certain share market investing was the best option?Working out the true, annualise return on my shares was damn tricky. No wonder investment advisors don’t do this for their clients.

To solve these problems Scott and I developed Sharesight. Not just for me but for all investors who have the problems I did.

In Sharesight your record keeping is automated. Your trades, dividends, share splits, dividend reinvestments and much more are all recorded for you.

You will love our tax reporting and you can see the true annualised return of every share you own and for your total portfolio over any time period you choose.

But wait – there’s more. Sharesight has been going 7 years now and has developed a host of other features over that time. Many of them kindly suggested by our customers, so please keep the feedback coming.

FURTHER READING

- Sharesight.com -- About Us

- Sharesight.com -- FAQ

- Blog -- These two reasons are why I founded Sharesight

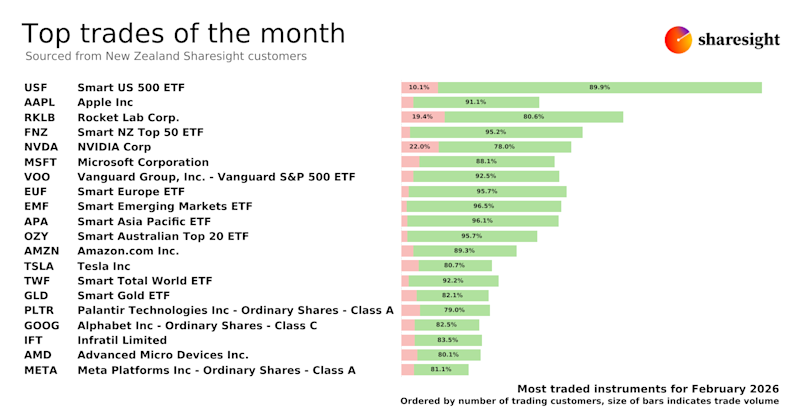

Top trades by New Zealand Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

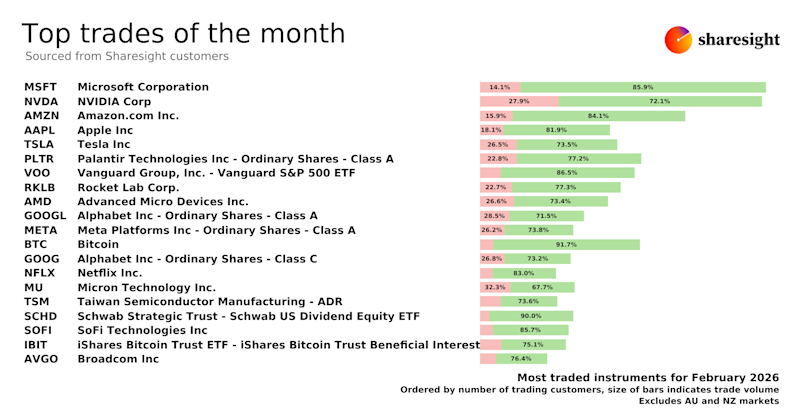

Top trades by global Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.

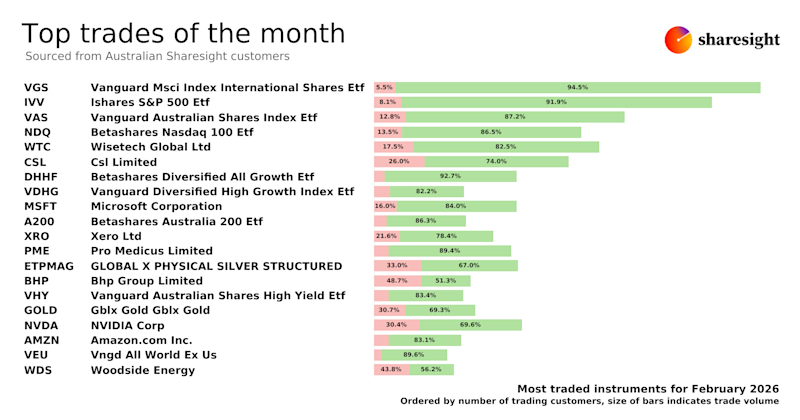

Top trades by Australian Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Australian Sharesight users.