Sharesight release notes – May 2022

Following strong demand from our US user base, the key highlight for May was adding over 24,000 US mutual funds to our ever-expanding dataset of investments. We also released various UX and usability improvements as noted below.

UX / Usability improvements

-

Migrated all Macquarie connections to our modernised mobile friendly connections screen

-

Completed a major update of the annual tax components form for Australian ETFs and managed funds

-

Made it easier to add cash accounts to empty portfolios

-

Expanded our new breadcrumbs to additional screens and improved the functionality on both mobile and desktop while also adding a new home icon to all breadcrumbs

-

Modernised the broker page for Marketech

-

Completed an overhaul of the opening balance file import

-

Introduced consistency across all report page headers

-

Updated styling on the portfolio settings page

New Functionality / Enhancements

-

Added support for over 24,000 US mutual funds

-

Expanded benchmarking beyond ETFs, equities and managed funds to include essentially all instruments

-

Added support for the Prague Stock Exchange

Broker Import Functionality (Trade Confirmations and CSV’s)

-

Added support for Superhero trade imports via CSV

-

Added support for Bell Potter trade imports via CSV

-

Added support for Desktop Broker trade imports via CSV

-

Added support for HSBC Australia trade imports via CSV

FURTHER READING

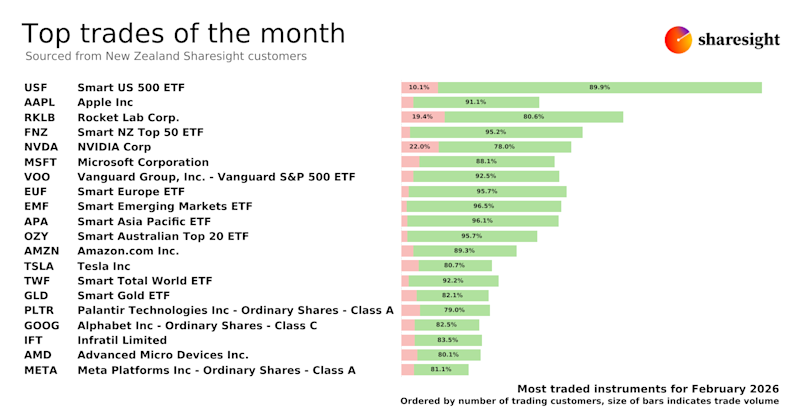

Top trades by New Zealand Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

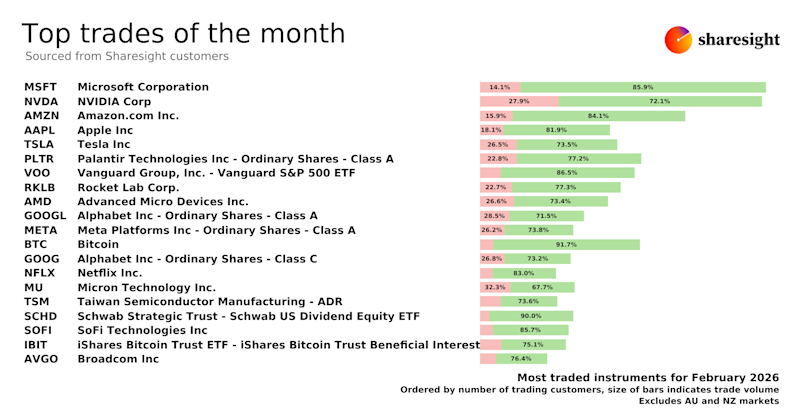

Top trades by global Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.

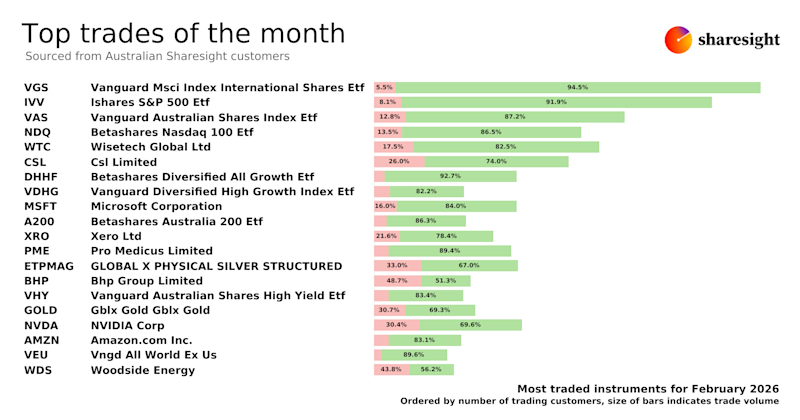

Top trades by Australian Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Australian Sharesight users.