Run your tax reports before ATO’s October 31 deadline

The deadline for Australians lodging their own tax return for the 2016-2017 financial year is October 31. If you’re like me, you’ll be spending the weekend getting your tax affairs in order to file in time. But the good news is that using Sharesight to track your investments makes tax time a breeze. Here’s how:

Comprehensive tax reports

With dividends and franking credits automatically accounted for, Sharesight saves you the hours normally spent tracking down investing-related data and paperwork. It also saves you potentially thousands of dollars in accounting fees (including hundreds spent on CGT reports alone) by letting you running your own tax reports:

1. Capital Gains Tax

Sharesight’s Australian Capital Gains Tax Report calculates capital gains made on shares as per ATO rules. The report is based on the ‘discount method’ for shares that were held for more than 1 year and the ‘other method’ for shares held for less than 1 year. It breaks down short and long term capital gains and capital losses, and allows you to customise your discount rate and sale allocation method. It even lets you “carry forward” any losses from the previous reporting period:

For $25 per month I was given back about 15 hours of my life usually devoted to manually calculating CGT.

Stephen Colman, Sharesight customer

2. Taxable Income

The Taxable Income Report breaks down all dividend and franking credits over any time period, and organises them by local/overseas income, as well as non-trust/trust income (such as ETFs):

3. Historical Cost

The Historical Cost Report displays opening and closing balances at cost price. It also includes a ‘market value’ column to allow a quick comparison between cost price and market value at the end of the chosen period:

Secure portfolio sharing

Whether you’re filing before the October 31 deadline (or at a later date depending on your situation), if you’re working with an accountant, you’ll want to share secure portfolio access with them. Available exclusively to upgraded subscribers, sharing your portfolio allows you to:

- Save time by no longer having to gather paperwork for your financial professional(s).

- Save money because they’ll have everything they need to work quickly and efficiently.

- Ensure everyone’s on the same page and focus on what really matters -- not just at tax-time but throughout the year.

To get started, simply sign up for a FREE Sharesight account and load your holdings.

FURTHER READING

Sharesight users' top trades – December 2025

Welcome to the December 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users over the month.

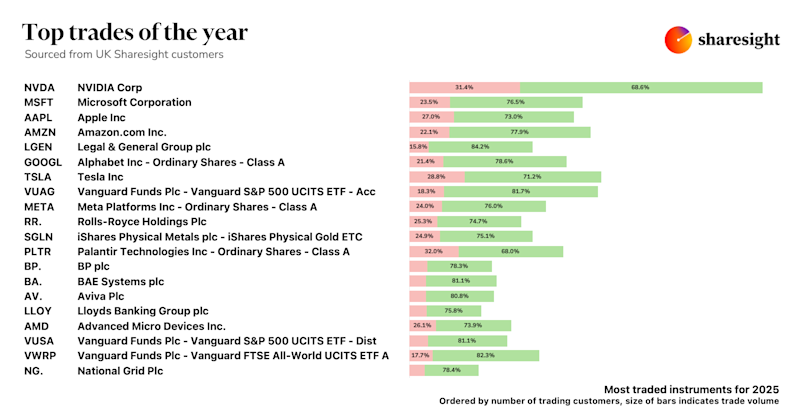

Top trades by UK Sharesight users in 2025

Welcome to the 2025 edition of our UK trading snapshot, where dive into this year’s top trades by the Sharesight userbase.

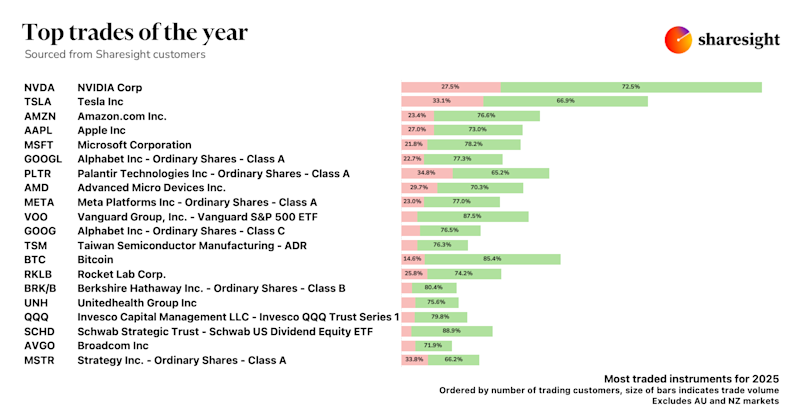

Top trades by global Sharesight users in 2025

Welcome to the 2025 edition of our global trading snapshot, where we dive into this year’s top trades by Sharesight users around the world.